DEMAT ACCOUNT KAHA OPEN KRWANA ?

DEMAT ACCOUNT OPEN KRWANE K LIE AAP KISI BHI BROKERING FIRM ME JAA SKTE HAI... YA FIR CALL KR SKTE HAI 09009077009....

DEMAT ACCOUNT FREE OPEN HOTA HAI....BUT KUCH CHARGES LGTE HAI JAISE...

DEMAT ACCOUNT AAP BHI APNE MOBILE SE OPEN KR SKTE HO IS BUTTON PR CLICK KIJIYE...

DEMAT ACCOUNT OPEN KRWANE KE LIE DOCUMENTS KONSE - KONSE LGTE HAI...?

*PAN CARD

* PASSPORT SIZE

* BANK STATEMENT / CANCELL CHEQUE

* MOBILE NUMBER (REGISTERED WITH ADHAAR)

* EMAIL ADDRESS

*SIGNATURE

*MOTHER'S NAME

DEMAT ACCOUNT OPEN KRWANE K LIE AAP KISI BHI BROKERING FIRM ME JAA SKTE HAI... YA FIR CALL KR SKTE HAI 09009077009....

DEMAT ACCOUNT FREE OPEN HOTA HAI....BUT KUCH CHARGES LGTE HAI JAISE...

DEMAT ACCOUNT AAP BHI APNE MOBILE SE OPEN KR SKTE HO IS BUTTON PR CLICK KIJIYE...

OPEN DEMAT ACCOUNT

DEMAT ACCOUNT OPEN KRWANE KE LIE DOCUMENTS KONSE - KONSE LGTE HAI...?

* ADHAAR CARD

*PAN CARD

* PASSPORT SIZE

* BANK STATEMENT / CANCELL CHEQUE

* MOBILE NUMBER (REGISTERED WITH ADHAAR)

* EMAIL ADDRESS

*SIGNATURE

*MOTHER'S NAME

IN SABHI DOCUMENTS K CLEAR PHOTO WHTSAPP KR KE AAP ACCOUNT OPEN KRWA SKTE HO... WHATSAPP NO. 09009077009

BROKERAGE CHARGE KYA HOTA HAI ? & KITNA LGTA HAI ??

JB HM NSE (NATIONAL STOCK EXCHANGE) / BSE (BOMBAY STOCK EXCHANGE) SE KOI SHARE BUY YA SELL KRTE HAI TO WO HM DIRECT NAHI KHARID SKTE HAI... USKO HME KISI BROKER K THROUGH HI KHRIDNA PDTA HAI..JO HMARA DEMAT ACCOUNT OPEN KRTA HAI USKO HM STOCK BROKER BOLTE HAI...

STOCK BROKER HMSE KUCH CHARGE LETA HAI ISKE 0.1% SE LEKR 0.03% TK

{ HMARE TOTAL (BUYING + SELLING) KA 0.1 %- 0.3 % }

JAISE.....

MAAN LO HMNE 1 LAKH KE SHARE BUY KIE HAI.... + 1 LAKH KE SHARE SELL KIE HAI = TOTAL 2 LAKH KI BUYING + SELLING HO JAYEGI

2 LAKH × 0.01 ÷ 100 = 20 RS

TOTAL AMOUNT × BROKERAGE ÷ 100 = BROKERAGE CHARGES

AUR IS BROKERAG CHARGES KE BDLE ME FACILITY BHI PROVIDE KRWATE HAI

JAISE.....

- HM HMARE MOBILE ME ANDROID APP SE BHI KOI SHARE BUY YA SELL KR SKTE HAI HAME KAHI JAANE KI JRURT NHI HOTI HAI...

- AGR KISI K PAAS ANDROID MOBILE NHI HAI AUR KEYPAID PHONE HAI TO WO CALL KR K BHI SHARE BUY YA SELL KR APNI TRADING PURI KR SKTA HAI...

- TRADING KRNE K BAAD JO PROFIT HOTA HAI USKO PAYOUT AASANI SE MOBILE K THROUGH BHI YA CALL KR KE BHI DEMAT ACCOUNT SE SAVING ACCOUNT ME TRANSFER KR SKTE HAI...

- FREE ME LEVEL'S AANA BUYING AUR SELLING K LIE

- AUR BHI KISI TARAH KI PRBLM HO CLIENT KO DEMAT K REGARDING TO HMARA STOCK BROKER HMARI HELP KRTA HAI....

DEMAT ACCOUNT WALI APPLICATION KESE KAAM KRTI HAI ?

YOUTUBE PR STOCK MARKET RELATED SAARE VIDEO DEKHE.....CLICK HERE

YOUTUBE PR STOCK MARKET RELATED SAARE VIDEO DEKHE.....CLICK HERE

- HMARA BROKER HME SHARE KHRIDNE K LIE 40 TIMES KI LIMIT BHI DETA HAI.... USKE BAARE ME PART 1 - SHARE MARKET DEKHE...

LIMIT KAISE CALCULATE KRE?

"SEBI" KYA HOTA HAI?

SEBI KA FULL FORM "SECURITY EXCHANGE BOARD OF INDIA" HAI AUR SEBI MAINLY NSE , BSE , BROKERING FIRM , ADVISORY FIRM , ETC IN SABHI PR NAJAR RAKHTI HAI AUR DHYAN RKHTI HAI KE INKE THROUGH KISI KE SATH KOI FRAUD TO NHI HO RHA HAI.... AGR HOTA HAI TO SEBI KO COMPLAIN KR SKTE HAI AUR WO US COMPANY K KHILAF ACTION LETE HAI....

HAMARE DEMAT ACCOUNT ME PAYMENT KAISE ADD KRNA HAI.....

.

.

.

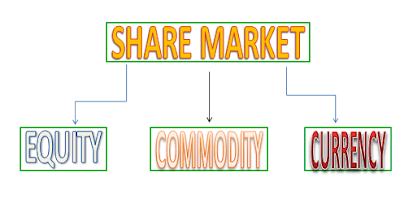

SHARE MARKET KYA HOTA HAI SMJHNE K LIE DEKHE..... PART 1 - SHARE MARKET